Even though the Amazon effect has made it seem like brick-and-mortar stores are dying, some businesses are still doing well. Even as Amazon enters the retail pharmaceutical market, CVS Health is seeking to thrive, not merely survive. CVS made headway in May 2018 on its $69 billion purchase of Aetna Inc. According to the most recent SEC filings, companies like Personal Resources Investment and or Strategic Management Inc. bought shares worth millions of dollars in June 2018. They bought 23,629 shares, CapWealth Advisors LLC bought 23,629 shares, as well as Sentry Investments Corp bought 153,800 shares. This guide is to let you know about how CVS makes its money.

Some History

All the way to 1922, CVS Health Corp. (formerly Consumer Value Stores) may be traced back. CVS, as it exists today, would be unrecognizable to the company's original founders. In the mid-1990s, the firm that is now known as CVS sold off all of its units except for the lucrative pharmacy operations, first as a shoe company and later as a general merchandiser. After that, it started buying up rival businesses like Eckerd, Sav-On, Osco, and Long's.

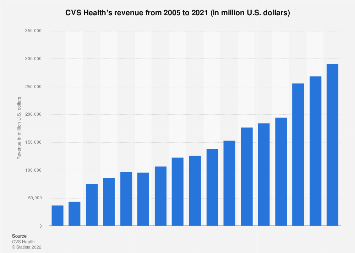

CVS now operates in 49 states, the District of Columbia, Puerto Rico, and Brazil, with approximately 9,800 retail locations. There are 246,000 employees employed by the business. CVS has four business segments for accounting purposes. Pharmacy, pharmacy benefit management, medical clinic, and specialty are in decreasing order of size. After a couple of years of stability, CVS's revenue stalled at $184.8 billion in 2017.

Prescriptions and Other Services

More than 67% of CVS's income comes from the pharmacy segment. Pharmacies should probably be referred to as "retail" stores instead of "pharmacies" in this context. Along with selling medications and delivering flu vaccines, a pharmacy also offers a wide range of "as seen on TV" novelty items like Snuggies and Slap Chops, as well as all the other typical convenience and incidental purchases that go along with a trip to the drugstore. The "MinuteClinic" chain of retail, medical clinics operated by CVS has 1,100 locations in 33 states under the "MinuteClinic" brand. However, CVS joined this market very recently and has already become the dominant player in it.

Benefits Management

Prescribing claims are handled by a department inside CVS called Pharmacy Benefit Management (PBM). Caremark is different from CVS's pharmacy operations because it is a high-volume business that works directly with drug makers to set prices, handle mail orders, etc. All the intangible bureaucratic guff that, in the early 21st century, seems to characterize the most advanced economies.

To top it all off, the CVS Specialized Department handles the expensive yet life-saving specialty medications. The $6,000 price tag for a single vial of Soliris is only required by one or two out of every thousand people who need a prescription both for Paxil or Xanax. Because some prescriptions are so uncommon, costly, and specialised, they need a CVS department all their own.

Some of CVS' specialty businesses include the Accordant, that also appears to give an insurance-paid care programme for patients with each of 17 serious conditions (emphasis on haemophilia, cystic fibrosis), Coram, which provides infusions for haemophilia, chronic heart failure, etc., and Novologix, which is responsible for claims software development. Coram sees an average of 45,000 patients each month, whereas CVS serves an average of 5 million clients every day.

It's unlikely that CVS would suffer any long-term consequences if it removed a high-margin item like cigarettes from its stores, a move that was likely taken largely for public relations reasons. To be fair, idealism can only go so far until it runs against realism. There have been no announcements from the corporation regarding the discontinuation of the sale of beer and wine.

How CVS Health Earns the Majority of Their Revenue

Despite the fact that the company's PBM accounts for a large portion of its revenue, margins in this area are extremely tight. CVS Health generated a meager operating profit of $784 million off pharmacy services sales of $31.2 billion in the first quarter. Its retail as well as long-term care businesses, are combined into a single segment that generated $1.41 billion of operating profits from $19.3 billion of revenue throughout the first quarter of this year. This means that the retail and long-term care divisions are by far the most essential in terms of generating earnings the corporation can return to shareholders.

Late last year, CVS Health said that new restrictions on pharmacy networks put in place by different insurance companies would cause them to lose about 40 million prescriptions. There was a 4.7 percent drop in sales in the first quarter because fewer customers attended the pharmacies to complete their prescriptions. We expect the market to grow again in the near future. Since Omnicare's recent acquisition, the firm hasn't revealed any new network constraints, and it has a significant presence in the long-term care sector.

Conclusion

The genuine national pastime of the United States of America is the consumption of medications, not freedom or football, as is commonly believed. Everything from anxiety to RLS has a pill or injection to treat the symptoms, and CVS is at the forefront of providing such medications to patients. It's conceivable that the amount of money CVS stockholders spend on medications will rise as the number of medical disorders being discovered outpaces the number of diseases being eliminated.